Do You Need Help with Free Cash Flow Statement Assignments?

How do you prepare a Statement of Cash Flow (SCF) Analysis? At first glance, this may be a complex subject matter to deal with. You will need to understand and calculate the components, factors, and transactions (e.g., discretionary and operating cash flows) that directly affect the SCF. Finance Homework can provide you a step-by-step guide on how to effectively and easily understand and prepare your SCF analysis.

Understanding everything involving statement of cash flows analysis can become a little confusing. It may appear fairly basic but when developing a cash flow statement model for a big company there are plenty of factors involved. You will need to understand the different types of cash flow such as discretionary and operating cash flows and how to calculate them. Some students may have trouble understanding the various calculations involved or some of the concepts. However, the finance homework service we provide is available whenever you need cash flow help with your assignments.

Understanding Statement of Cash Flows Analysis

According to International Accounting Standard (IAS) 7, Statement of Cash Flows, cash flows are defined as the inflows and outflows of cash and cash equivalents over the specific period of the entity. The reason why we do analysis on the entity’s SCF is to identify useful information on the entity’s financial situation and determine how the cash goes in and out of the entity which includes determining specific financial ratios (e.g., liquidity ratio and solvency ratio).

Cash flow is the cash that is spent or received over a period of time by a business. The cash flow statement is the financial statement used to report the inflows and outflows of cash over a specific period of time. An analysis of the cash flow statement can provide useful information to a company regarding their financial situation. The statement of cash flows is made up of three parts:

- Operating activities: Activities describing cash that came in or went out of a company as a result of normal, day-to-day operations of a company. Operating Activities include transactions involving cash used to purchase from suppliers or cash received as payment from customers, as a result of the normal or day-to-day operations of the entity

- Investing activities: Income that came in or went out of a business as a result of transactions that involved the purchase or sale of items such as property, or equipment. Investing activities include cash paid to acquire or cash received to dispose long-term assets, as well as other investments that are not included under the cash equivalents account.

- Financing activities: Income that came in or went out of a business as a result of agreements with shareholders and/or investors. Financing activities include cash transactions on acquisitions and disposals that affect the shareholders and/or investors of the entity.

Some cash flows are specifically defined such as operating cash flow or discretionary cash flow. Free cash flow is the cash flow that a company generates that is available to long term investors. The free cash flow statement requires the following information that is used to calculate free cash flow:

- After tax operating profit

- Depreciation expense

- Capital expenditures

- Increase/decrease in net working capital

Free cash flow = After-tax operating profit plus depreciation expense minus capital expenditures plus the increase in net working capital (or plus the decrease in net working capital). It is important that a business knows things such as free cash flow. Statement analysis enables a business to determine this and much more.

Examples of the activities that affect the SCF, are as follows (based on IAS 7):

| Operating Activities | Investing Activities | Financing Activities |

| Cash receipts from the sale of goods and the rendering of services | Cash receipts from sales of property, plant and equipment, intangibles and other long-term assets | Cash proceeds from issuing shares or other equity instruments |

| Cash receipts from royalties, fees, commissions and other revenue | Cash payments from sales of property, plant and equipment, intangibles and other long-term assets | Cash payments to owners to acquire or redeem the entity’s shares |

| Cash payments to suppliers for goods and services | Cash advances and loans made to other parties (other than advances and loans made by a financial institution) | Cash proceeds from issuing debentures, loans, notes, bonds, mortgages and other short or long-term borrowings |

| Cash payments to and on behalf of employees | Cash receipts from the repayment of advances and loans made to other parties (other than advances and loans of a financial institution) |

Cash repayments of amounts borrowed |

| Cash receipts and cash payments of an insurance entity for premiums and claims, annuities and other policy benefits | Cash receipts from sales of equity or debt instruments of other entities and interests in joint ventures | Cash payments by a lessee for the reduction of the outstanding liability relating to a finance lease |

| Cash payments or refunds of income taxes unless they can be specifically identified with financing and investing activities | Cash payments to acquire equity or debt instruments of other entities and interests in joint ventures | |

| Cash receipts and payments from contracts held for dealing or trading purposes |

Method for Presenting Statement of Cash Flows

IAS 7 identifies two (2) methods for presenting the SCF of the entity:

- Direct Method (preferred)

Presents the SCF through classifying transactions per activities, to show the gross cash receipts and payments made by the entity, which shall be used to compute the ending cash balance.

- Indirect Method

The SCF shall be prepared starting from the reported net income of the entity, which shall be adjusted by the increase/decrease in the non-cash accounts, deferrals, accruals and items of income or expense that are associated with items classified as investing and/or financing activities.

Illustration 1. ABC Company’s statement of financial position for December 31, 2017 reported the following:

| Statement of Financial Position | ||||

| ABC Company | ||||

| 2017 | 2016 | |||

| ASSETS | ||||

| Current Assets | ||||

| Cash | $20,000 | $22,380 | ||

|

Accounts receivable – net

|

13,500 | 16,650 | ||

| Inventory | 10,000 | 5,370 | ||

|

Prepaid expenses

|

4,500 | 4,500 | ||

| Total Current Assets | 48,000 | 48,900 | ||

| Non-Current Assets | ||||

|

Plant, property and equipment – net

|

42,500 | 45,500 | ||

| TOTAL ASSETS | $90,500 | $94,400 | ||

| LIABILITIES AND SHAREHOLDER’S EQUITY | ||||

| LIABILITIES | ||||

| Current Liabilities | ||||

|

Accounts payable

|

$13,000 | 14,850 | ||

| Interest payable | 2,000 | 2,000 | ||

|

Income taxes payable

|

1,500 | 1,650 | ||

|

Dividends payable

|

500 | 500 | ||

| Total Current Liabilities | 17,000 | 19,000 | ||

| Non-Current Liabilities | ||||

|

Long-term loans payable

|

21,000 | 30,000 | ||

| Total Liabilities | 38,000 | 49,000 | ||

| Shareholder’s Equity | ||||

|

Common stock ($1 par value)

|

30,000 | 25,000 | ||

|

Retained earnings

|

22,500 | 20,400 | ||

| Total Shareholder’s Equity | 52,500 | 45,400 | ||

| TOTAL LIABILITIES AND SHAREHOLDER’S EQUITY | $90,500 | $94,400 | ||

During the year, ABC Company reported the following figures and transactions:

- Collected $3,500 from Customer EFG as settlement of its accounts receivable.

- Paid $1,600 to a supplier of office supplies for purchases made on account.

- Purchased Truck No. 1943 from XYZ supplier for $2,500 to be used for delivering merchandise to their customers.

- Sold two (2) of their old trucks for $3,000, which resulted in a loss on sale of $1,900.

- ABC Company issued additional 5,000 common stock at $1 par value.

- Settled it long-term debt amounting to $9,000.

- ABC Company reported earnings before tax of $2,600 during the year.

- The company computes for their allowance for doubtful accounts at 10% of its accounts receivable.

- Depreciation expense for the year was recorded at $4,000.

- Amortization expense of $5,000 was reported during the year.

- A 30% tax rate shall be used in computing the net income of ABC Company.

Based on the information provided, prepare ABC Company’s statement of cash flows for the period ending December 31, 2017 using the:

- Direct method

- Indirect method

Solutions:

- Direct Method

| Statement of Cash Flows (Direct Method) | |||||

| ABC Company | |||||

| For the period ending December 31, 2017 | |||||

| Ref | |||||

| Cash flows from operating activities | |||||

| Add: | Cash received from Customer EFG from settlement of their accounts receivable | (a) | $3,500 | ||

| Less: | Payment to supplier of office supplies for purchases made on account | (b) | 1,600 | ||

| Income taxes paid | (j) | 780 | $1,120 | ||

| Cash flows from investing activities | |||||

| Add: | Sale of two (2) old trucks | (d) | 3,000 | ||

| Less: | Purchase of Truck No. 1943 from XYZ Company | (c) | 2,500 | 500 | |

| Cash flows from financing activities | |||||

| Add: | Issuance of 5,000 common stock at $1 par value | (e) | 5,000 | ||

| Less: | Settlement of $9,000 long-term debt | (f) | 9,000 | -4,000 | |

| Decrease in cash balance | -$2,380 | ||||

| Beginning cash balance – January 1, 2017 | 22,380 | ||||

| Ending cash balance – December 31, 2017 | $20,000 | ||||

- Indirect Method

| Statement of Cash Flows (Indirect Method) | ||||

| ABC Company | ||||

| For the period ending December 31, 2017 | ||||

| Net income | $1,820 | |||

| Cash flows from operating activities | ||||

| Depreciation Expense | 4,000 | |||

| Gain on sale of property, plant and equipment | 1,900 | |||

| Amortization expense | 5,000 | |||

| Change in working capital assets: | ||||

| Add: | Decrease in accounts receivable | -3,150 | ||

| Less: | Increase in inventory | 4,630 | ||

| Decrease in accounts payable | 1,850 | |||

| Decrease in income taxes payable | 150 | $1,120 | ||

| Cash flows from investing activities | ||||

| Add: | Sale of two (2) old trucks | 3,000 | ||

| Less: | Purchase of Truck No. 1943 from XYZ Company | 2,500 | 500 | |

| Cash flows from financing activities | ||||

| Add: | Issuance of 5,000 common stock at $1 par value | 5,000 | ||

| Less: | Settlement of $9,000 long-term debt | 9,000 | -4,000 | |

| Decrease in cash balance | -$2,380 | |||

| Beginning cash balance – January 1, 2017 | 22,380 | |||

| Ending cash balance – December 31, 2017 | $20,000 | |||

Formulas for Other Areas of Statement of Cash Flow Analysis

Free Cash Flows (FCF)

Represents the cash that can be generated by the entity after its expenditures required to maintain or expand its asset base, which is important to assess shareholder’s value.

Formula for computing FCF is as follow:

Free Cash Flow (FCF)=Operating Cash Flows-Capital Expenditures =After tax Operating Income+Depreciation Expense-Capital Expenditures +Increase/Decrease in Net Working Capital

Illustration 2. ABC Company reported $20 million from its operating activities and had $6 million for its capital expenditures. How much is the free cash flow to be reported by the ABC Company?

Solution:

Free Cash Flow = $20 million – $6 million = $14 million

Discretionary Cash Flows (DCF)

Represents the remaining cash that can be used by the entity in its discretionary projects, after all capital projects with positive net present values (NPV) have been satisfied and financed.

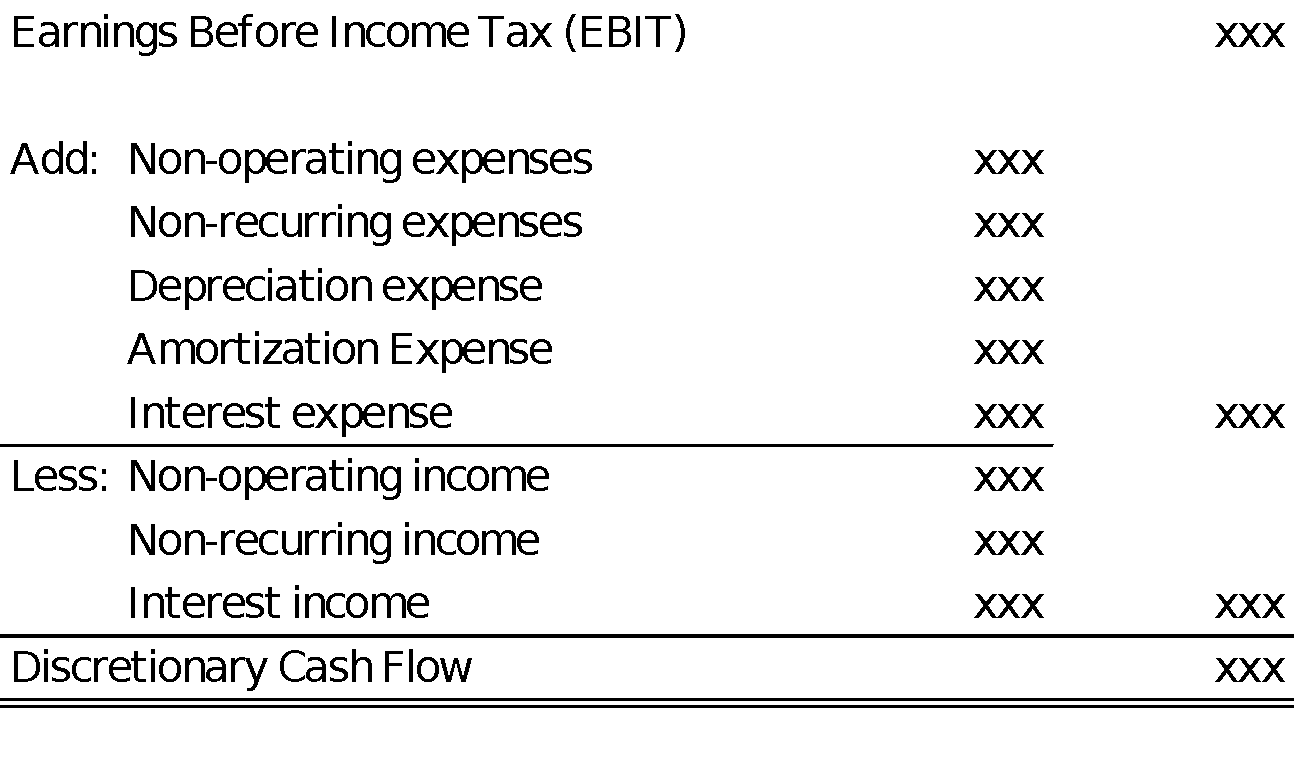

The formula for computing DCF is as follow:

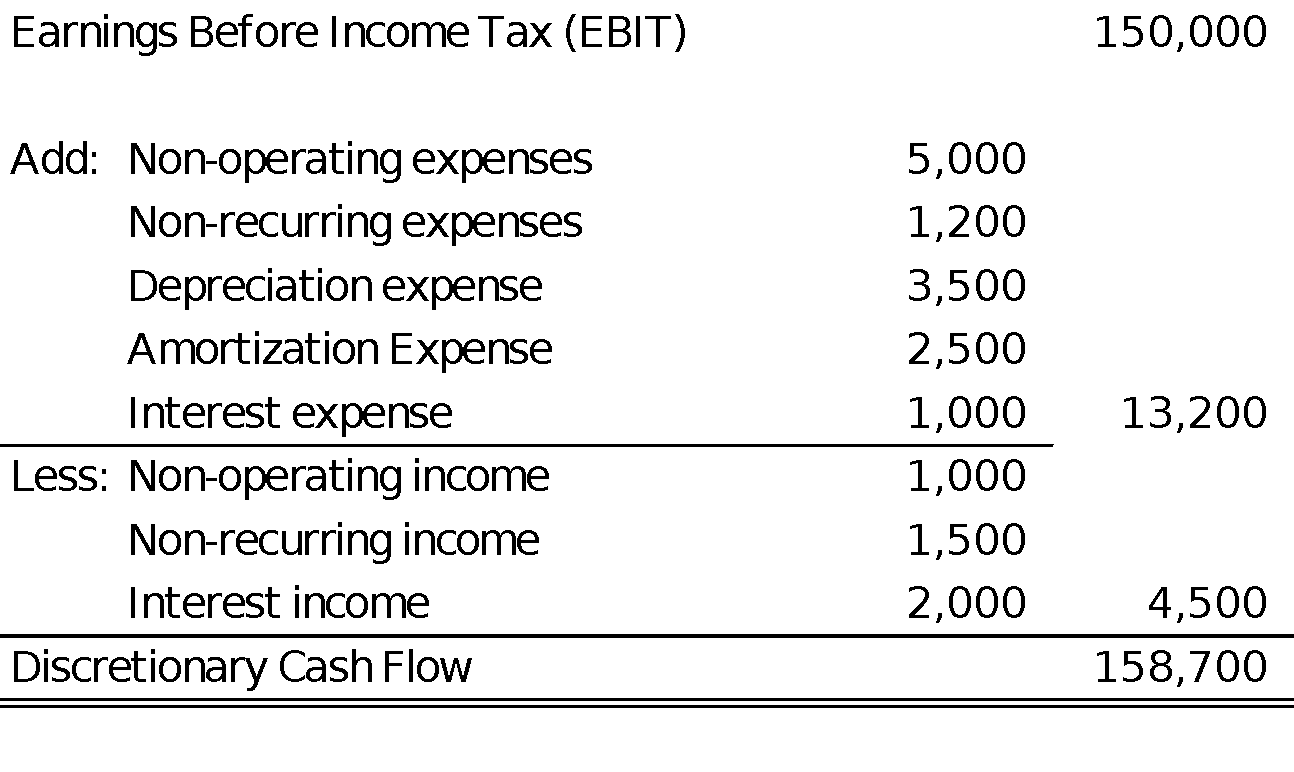

Illustration 3. ABC Company reported earnings before tax of $150,000. It reported non-operating expenses for $5,000, non-operating income for $1,000, non-recurring expenses for $1,200, non-recurring income for $1,500, interest expense for $1,000, interest income for $ 2,000, depreciation expense for $3,500, and amortization expense for $2,500. How much is the discretionary cash flow available for the company?

Solution:

Get Help with Your Cash Flow Statement Homework Assignments

Our service provides finance homework help for any academic level on any finance topic. Every tutor we use has a degree in finance or a related field, many at the graduate level. We use professionals who are experts in finance and provide finest management homework help. They can provide the solutions to your homework problems and explain how they arrived at the answer so that you understand the concepts involved. Additional benefits of using our service include:

- Guarantees of complete satisfaction and on time delivery with all work we provide

- Affordable rates that will fit your budget

- Easy online order and payment process

- Customer support 24/7