Why Do You Need to Understand What Is Profitability Ratios?

Most businesses operate for one reason and that is to simply make a profit, how well they make that profit is gauged through financial metrics known as profitability ratios. Understanding what do profitability ratios measure is vital if you are going to assess a company’s performance. If you still think “why should I do my homework on this topic?”, let’s find out the answer here.

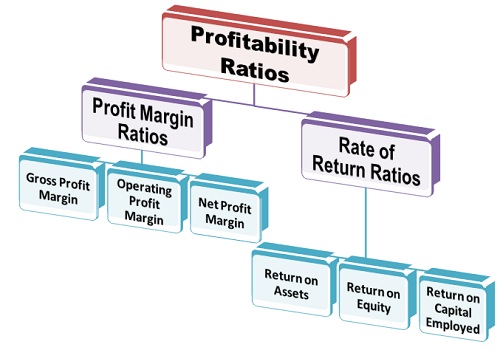

There are several types of profitability ratios that are calculated for a company and they can help you to make comparisons between a company and its competitors or against past performance. They are the measures that provide an insight into the survivability of the business and the benefits that it can generate for its shareholders. The following sections will run through each of the different types of profitability ratios as well as provide you with the formulas that are used to perform the calculations.

Image credit: businessjargons.com

Profit Margin Analysis

There are four measures of profit margin that are reported on your income statement. These are Gross profit, your operating profit, pretax profit and finally net profit. These are usually reviewed over a 3-5 year period as well as being compared to industry benchmarks and competitors.

Gross profit margin

This is often thought of as the cost of sales or the cost of goods sold. This metric reflects the expenses that are labor, raw material and overhead related and are most important within manufacturing style companies. The higher the percentage the better as this indicates that your materials, labor and fixed assets related to manufacturing are being utilized well to generate your profit.

Often a company may have limited control over some of these costs such as raw materials. Prices could be increased with little warning without the company having any possibility of affecting the increases being made. Especially is costs are down to political issues such as Brexit affecting currency exchange rates.

The formula for generating your gross profit margin is:

Gross profit margin ratio = Gross profit / Net sales (Revenue)

Operating profit margin

We subtract the operating (SG&A – Selling, General and Administrative) expenses form the gross profit to arrive at our operating income. This is a much better reflection of how the management of the company is performing and movements in this metric can indicate actions taken by the company management. This is often the preferred profit margin to be used.

The operating profit margin is calculated using the following:

Operating Profit Margin ratio = Operating profit / Net Sales (Revenue)

Pretax profit margin

This ratio can be manipulated as most companies will have access to a variety of different techniques to manage their taxes. This is calculated through:

Pretax Profit Margin Ratio = Pretax profit / Net Sales (Revenue)

Net profit margin

Often simply referred to as the bottom line or the company’s profit margin as it is the final measure of the company’s profitability. This ratio is gained through the following calculation:

Net Profit Margin Ratio = Net Income / Net Sales (Revenue)

Effective tax rate ratio

By comparing a company’s income tax expenses to its pretax income we gain a ratio that reflects the company’s tax rate. This provides us with a good indication of the level of taxation that the company is facing.

While this is a good and important ratio to monitor it does tend to reflect more on the company’s accountant’s ability to implement tax management techniques than the actual management of the company. Fluctuations in this ratio year on year tend to be more of an indication of accounting practices changing.

This ratio is calculated by the following:

Effective Tax Rate Ratio = Income Tax Expenses / Pretax Income

Return on assets ratio

This important ratio will help you to understand just how profitable the company is in comparison to the assets that it holds. Return on Assets (ROA) compares net income with the average assets held by the company and will reflect how well the management of the company is using those assets to generate a profit.

Different styles of businesses will have very different ratios depending on how capital intensive they are. For instance, technology companies are going to have a very different ratio to a company that employs heavy industry. Microsoft, for instance, has a ROA ratio of 18% while General Electric operates at around 2.3%.

Discover all Excel yield function tricks by following the link!

Comparisons between companies even in similar industries should always be treated with care when considering this ratio. Investment professionals would generally expect this measure to be no less than 5%.

This ROA ratio is calculated with the following formula:

Return on Assets Ratio = Net Income / Average Total Assets

Return on equity ratio

A simple definition for this ratio is how well the company is utilizing the investment that the shareholders have made in the company to generate a profit. The higher a number that this number returns the more effective the company is in generating a return for its investors.

Return on Equity (ROE) is a preferred measure used by investors to measure a company’s attractiveness for investment. Ratios of 15 to 20% are often considered as being a good indication of a company worth investing in.

It does however have a weakness in that when looking at the calculation result high levels of debt can cause the figure to rise causing a less savvy investor to get the wrong ideas regarding the company’s profitability.

The ROE is calculated through the following calculation:

Return on Equity Ratio = Net Income / Average Shareholders’ Equity

Return on capital employed ratio

ROCE – Return on Capital Employed adds the company’s debt liabilities or funded debt onto the equity to get a reflection on the total capital employed by the company. This gives you a much better understanding of the ability of the company to create returns from the whole capital base.

This is far better than measure than using ROE on its own and provides analysts with a far more comprehensive indication of the company’s profitability and the management’s ability to use the total capital to generate an income.

A company’s ROCE ratio should be at or above the average borrowing rate for the company as a general rule of thumb. Do not, however, confuse this measure with Return on Common Equity and check how a company has calculated their assets and debts as there are variations.

The calculation for this ratio is:

Return on Capital Employed Ration = EBIT / Capital Employed

Where EBIT is Earnings Before Interest and Taxes, and Capital Employed is Average Debt liabilities added to average shareholder Equity.

Avoiding Issues with Your Assignment on Profitability Ratios

Getting the best grades for all of your assignments is very important if you want to pass your course with the required results to continue your studies. This means taking great care and investing the required time and energy into understanding the different types of profitability ratios that you will need to understand and calculate.

Getting your assignments completed to the required standards, however, is not always easy. They following advice will help you to avoid some of the issues that you may encounter when working with profitability ratio formulas:

- Understanding what is actually being asked of you; make sure that you pay full attention during all classes and do all of the reading that is expected. Most assignments are designed to build on what you have been doing in class; if you don’t fully understand then ask your tutor.

- Selecting the right equations to use; don’t rely solely on what you see online, better to select what you have been shown in the class or within your textbook as there are some variations within some calculations.

- Getting the calculations correct; while the ratios themselves are fairly straightforward, the supporting information that is required can be hard to put together. Take great care to review your spreadsheets to ensure that they are correct.

- Submitting poorly written work; just because finance expects you to work with numbers does not mean that you can slack off on your writing. Simple and avoidable mistakes will see your grades significantly reduced as you still have to work on your communication skills.

We Can Help with Your Profitability Ratios Homework

Finance is not an easy subject to complete your assignments in and this is why many students at all levels within their education will turn to our services for help. Through our specialized services you will get to work with a finance expert that holds a post graduate degree as well as many years of tutoring experience at your level. They work with you to provide support that will ensure that you can submit work of a high standard worthy of the best grades.

The help that we provide is always proofread to a high standard and all calculations are tested and explained in full detail to ensure your understanding. We offer you a full satisfaction money back guarantee and our highly affordable support will always deliver on time so that your homework never misses its deadline.