Where to Get Mergers and Acquisitions Checklist Help

Mergers and acquisitions are often included in finance courses whether you are majoring in finance, or if you have another major that requires you take some finance courses. Some students encounter difficulties with various aspects involved in this part of finance. Examples of mergers and acquisitions problems students have to include understanding the concepts involved, keeping track of the many variables that must be considered and the various calculations that need to be performed. Our company provides finance homework help that includes mergers and acquisitions services to assist you with any problems you may run into.

Mergers and acquisitions are often included in finance courses whether you are majoring in finance, or if you have another major that requires you take some finance courses. Some students encounter difficulties with various aspects involved in this part of finance. Examples of mergers and acquisitions problems students have to include understanding the concepts involved, keeping track of the many variables that must be considered and the various calculations that need to be performed. Our company provides finance homework help that includes mergers and acquisitions services to assist you with any problems you may run into.

Examples of Mergers and Acquisitions Methods and Tools

When the combined value of two (2) entities is greater than the value of each entity accounted individually, a ‘synergy’ is created. The creation of synergy is what pushes companies to move towards mergers and acquisitions, in view that it will help strengthen their financial capability. Business combinations can be classified into two (2), namely mergers and acquisitions.

The common process for mergers and acquisitions is the Merger happens when one company agrees to merge with another company to operate jointly as a single entity. On the other hand, the acquisition is where a company takes over another which results in a newly formed company.

To simply put it:

| Merger: | Company A + Company B = Company AB |

| Acquisition: | Company A + Company B = Company C |

Several methods may be employed to finance mergers and acquisitions, some of which include payment by cash from retained earnings or bonds, leveraged buyout, or a combination of cash and debt issuances.

There are three (3) types of merger and acquisition that can form between the contracting parties:

| Types of Merger | Definition | |

| 1 | Horizontal | A type of merger and acquisition wherein Company A merges with Company B, who is a competitor that operates in the same industry or is selling identical products or services. |

| 2 | Vertical | A type of merger and acquisition wherein Company A merges with Company B, who is a customer or supplier, regardless whether on their geographical area. |

| 3 | Conglomerate | A type of merger and acquisition wherein Company A merges with Company B, regardless whether they operate in the same industry or is selling identical products or services. |

Methods for Accounting Mergers and Acquisitions

There are different ways to account for mergers and acquisitions, which includes:

- Pooling method

| Company A | Company B | Company AB |

| Assets1 | Assets2 | Assets1+Assets2 |

| Liabilities1 | Liabilities2 | Liabilities1+Liabilities2 |

| Equity1 | Equity2 | Equity1+Equity2 |

| Income1 | Income2 | Income1+Income2 |

| Expenses1 | Expenses2 | Expenses1+Expenses2 |

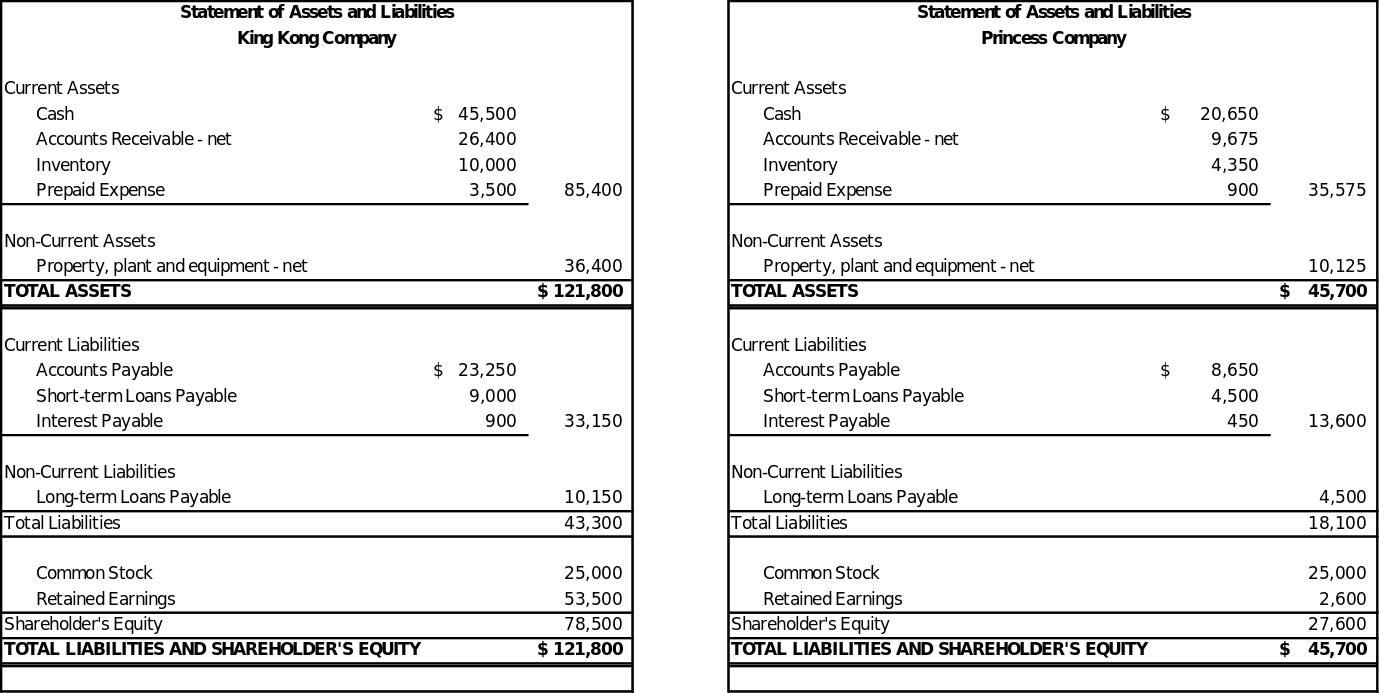

Illustration 1.On October 31, King Kong Company entered into a business combination with Princess Company, whose respective financial statements are as follows:

What will be the combined financial statement of the two (2) companies as a result of the merger?

Solution:

| Statement of Assets and Liabilities | |||

| Princess Company | |||

| Current Assets | |||

| Cash | $66,150 | ||

| Accounts Receivable – net | 36,075 | ||

| Inventory | 14,350 | ||

| Prepaid Expense | 4,400 | 120,975 | |

| Non-Current Assets | |||

| Property, plant and equipment – net | 46,525 | ||

| TOTAL ASSETS | $167,500 | ||

| Current Liabilities | |||

| Accounts Payable | $31,900 | ||

| Short-term Loans Payable | 13,500 | ||

| Interest Payable | 1,350 | 46,750 | |

| Non-Current Liabilities | |||

| Long-term Loans Payable | 14,650 | ||

| Total Liabilities | 61,400 | ||

| Common Stock | 50,000 | ||

| Retained Earnings | 56,100 | ||

| Shareholder’s Equity | 106,100 | ||

| TOTAL LIABILITIES AND SHAREHOLDER’S EQUITY | $167,500 | ||

2. Purchase Method (preferred)

Under the purchase method, the purchase price and cost of acquired assets are allocated to the fair value of net identifiable assets and liabilities (ratio and proportion method). Goodwill shall be recognized when purchase price exceeds the fair value of net assets, which is common in most cases. Any gains on losses on the merger or acquisition shall be recorded by the acquiring company in its financial statements retrospectively. Generally, the purchase method computes for the goodwill that may be recognized as a result of the business combination, which shall be computed as:

Goodwill=Purchase Price-Fair Value of Net Identifiable Assets

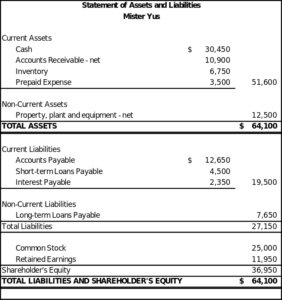

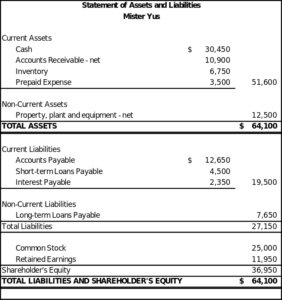

Illustration 2. On December 31, Miss Terry Company, the acquiring company, entered into a business combination with Mister Yus Company for a purchase price of $650,000, which was paid in cash. The statement of financial position of Mister Yus Company as of acquisition date is as follows:

One of its customers declared bankruptcy, whose corresponding accounts receivable of $900 is now deemed uncollectible and should be written-off.

One of its customers declared bankruptcy, whose corresponding accounts receivable of $900 is now deemed uncollectible and should be written-off.- A typhoon hit the warehouse of Mister Yus Company during the year, which resulted in some of its inventory worth $750 to be damaged and should be written-off.

- The company’s depreciation on property, plant and equipment – net is understated by $500

- Interest expense of $650 was not accrued for the period ending.

Calculate the amount of goodwill to be recognized as a result of the business combination.

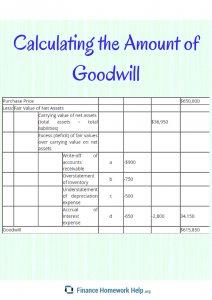

Solution:

| Purchase Price | $650,000 | ||||||

| Less: | Fair Value of Net Assets | ||||||

| Carrying value of net assets (total assets – total liabilities) |

$36,950 | ||||||

| Excess (deficit) of fair values over carrying value on net assets | |||||||

| Write-off of accounts receivable | a | -$900 | |||||

| Overstatement of inventory | b | -750 | |||||

| Understatement of depreciation expense | c | -500 | |||||

| Accrual of interest expense | d | -650 | -2,800 | 34,150 | |||

| Goodwill | $615,850 | ||||||

An acquisition is when one company takes over another and clearly establishes itself as the new owner. A merger happens when two firms agree to go forward as a single new company rather than remain separately owned and operated. The key principle of mergers and acquisitions is to create synergy. Synergy is achieved when the value of the two companies combined is more than that of the two individual companies. There are many different types of mergers and acquisitions and they may be handled in a number of different ways but they all have the goal of creating synergy.

Some examples of mergers and acquisition methods include:

- Purchase Mergers – A merger that occurs when one company purchases another. The purchase is made with cash or through the issue of some kind of debt instrument and the sale is taxable

- Consolidation Mergers – A merger where a new company is formed and both companies involved are bought and combined under the new company.

- Reverse merger – A type of acquisition where a private company buys a publicly-listed shell company and reverse merges into the public company to form a new public corporation. This is a way for a private company to go public faster

When acquiring a company it is necessary to determine its value. A mergers and acquisitions checklist of tools to determine a company’s value may include:

- Price-Earnings Ratio (P/E Ratio) – An acquiring company makes an offer that is a multiple of the earnings of the target company.

- Enterprise-Value-to-Sales Ratio (EV/Sales) – With this ratio, the acquiring company makes an offer as a multiple of the revenues.

- Discounted Cash Flow (DCF) – Discounted cash flow analysis determines a company’s current value according to its estimated future cash flows.

Our finance experts are always available when you need mergers and acquisitions or free cash flow statement help.

Our Online Mergers and Acquisitions Services

We offer assistance with any type of finance homework including mergers and acquisitions. Our finance experts can provide solutions to your finance homework problems and tutoring is also available. All of our tutors have degrees in finance or a related field, many at the graduate level. They also have extensive experiencing with finance tutoring and are able to explain difficult concepts in a way you can understand. Benefits of our service include:

- Guarantees of complete satisfaction on all work we provide

- Inexpensive rates that students can afford

- Customer support 24/7

- Complete customer confidentiality