Your Personal Finance Homework Help

Personal finance is the financial management that an individual performs to budget, save, and spend monetary resources. It must take into account various financial risks and future needs. When planning your personal finances you must consider if you require various financial products for banking, investment and insurance. Retirement plans, social security benefits, and income tax management should also be incorporated into your plan.

Personal finance is the financial management that an individual performs to budget, save, and spend monetary resources. It must take into account various financial risks and future needs. When planning your personal finances you must consider if you require various financial products for banking, investment and insurance. Retirement plans, social security benefits, and income tax management should also be incorporated into your plan.

Many people have never thought about personal finance before it was introduced to them in school. Our finance homework service can provide personal finance homework help anytime you require and is always available. The key to good personal finance management is planning.

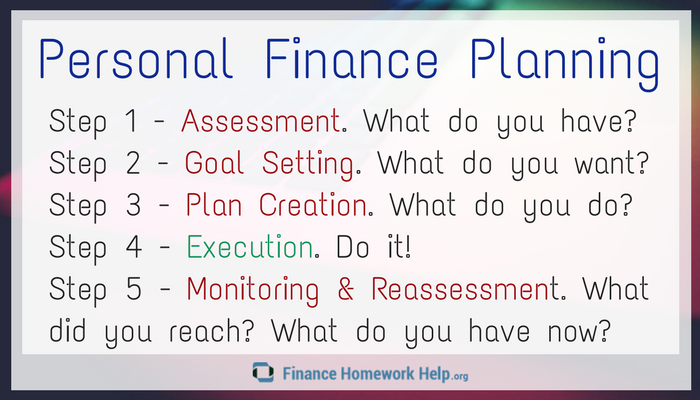

There are five steps in the personal finance planning process:

- Assessment: You can assess your financial using simplified versions of financial statements including balance sheets and income statements.

- Goal setting: Having multiple goals is common, including a mix of short and long term goals. Having financial goals helps guide financial planning, and should have an objective to meet specific requirements.

- Plan creation: The financial plan maps out how to accomplish your goals. It might include cutting back on expenses or investing in stocks.

- Execution: This is carrying out your plan and usually requires self-discipline. Many people obtain personal finance help from professionals like accountants, financial planners, investment advisers, and lawyers.

- Monitoring and reassessment: Your financial plan should be monitored and adjustments made as necessary.

Focus of Your Personal Finance Planning

Focusing on the following areas is recommended when planning your personal finances:

- Financial position: Personal resources available can be determined by examining net worth and household cash flow.

- Adequate protection: Insurance protects you from unexpected risks. These risks can be divided into liability, property, death, disability, health and long-term care

- Tax planning: Usually income tax is the single largest expense in a household and taxes can’t be avoided. Incentives in the form of tax deductions and credits can be used to reduce your taxes sometimes

- Investment and savings goals: Major reasons to invest and save include purchasing a house or car, starting a business, paying for education expenses, and saving for retirement.

- Retirement planning: This includes estimating how much it will cost to live when you retire as well as how to get the amount you need.

- Estate planning involves planning for the disposition of one’s assets after death.

In addition to focusing on the areas mentioned, keep the following tips in mind as you plan:

- Keep track of every expense, no matter how small. Many people are amazed when they realize how much money they waste.

- Use accurate descriptions when listing what you spend. Think of yourself as a personal finance writer, and instead of using some abbreviation you will forget, write it out.

- Plan for inflation. Money loses value over time. You need to stay ahead of inflation.

- Be flexible and be thorough. You need to be willing to change things from time to time to ensure your personal finance plan continues to meet your needs. Being thorough means tracking expenses, looking for the best rates on things like insurance and other bigger expenses.

Advantages of Using Our Finance Homework Service

There are many advantages of using our finance homework service including:

- Professional finance tutors with graduate degrees in finance or a related field waiting to help you.

- Guarantees on all personal and corporate finance homework help we provide and for on-time delivery

- Affordable rates that will fit in a tight budget

- Live customer support 24/7